SBX Accountants Partners with Skylight Mortgages to Simplify Financing for Small Business Owners

Ryan Scott • 15 May 2025

Combining Mortgage Expertise with Trusted Accounting Services

SBX Accountants is pleased to announce a strategic partnership with Skylight Mortgages — an experienced mortgage brokerage known for its tailored advice to both individuals and business owners. This collaboration is designed to offer our clients a more comprehensive approach to financial wellbeing, combining expert mortgage support with the accounting and tax services we already provide.

Why We've Teamed Up

At SBX, we understand that securing a mortgage can be particularly challenging for self-employed individuals, freelancers, and small business owners. Traditional lending criteria often don't accommodate the unique financial situations of our clients.

To better support our clients in working around these challenges, we've established a collaborative partnership with Skylight Mortgages, an independent mortgage brokerage based in Hemel Hempstead to bridge that gap. Their expertise lies in assisting clients with diverse financial backgrounds, including first-time buyers, home movers, remortgaging, and buy-to-let investments.

Why Skylight Mortgages:

We’ve chosen to work with Skylight Mortgages because of their deep understanding of how complex the mortgage process can be - especially for self-employed individuals and business owners. Their team takes a hands-on, tailored approach to finding the right mortgage solutions for each client, no matter how straightforward or unconventional their circumstances may be.

Whether you’re a first-time buyer, looking to remortgage, moving home, or investing in buy-to-let, Skylight Mortgages offer clear, practical advice that cuts through the noise. They’re known for being approachable, responsive, and committed to securing outcomes that align with both short- and long-term financial goals.

Supporting Both Individuals and Small Businesses

While many of our clients run businesses, we know that mortgage needs are personal. This partnership ensures that whether you’re buying your first home, refinancing, or planning a buy-to-let portfolio through a limited company, you’ll have access to the right advice with your broader financial picture in mind.

We’re excited about what this means for our clients, and we’re always looking to expand our support network to offer more value through trusted partnerships.

If you’d like to find out more or be introduced to

Skylight Mortgages, just drop us a WhatsApp - we’ll be happy to make the connection.

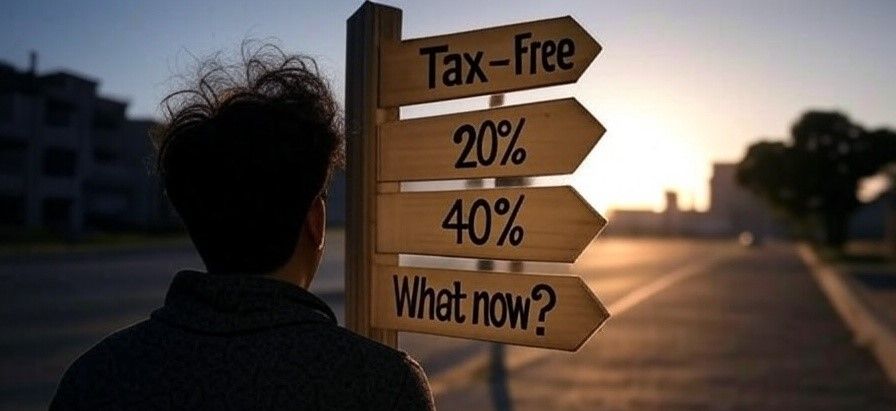

A recent poll suggests that many adults in the UK do not fully understand how income tax works. This lack of understanding can lead to missed opportunities or poor financial decisions. In this guide, we aim to clarify how income tax is calculated, explain common misconceptions, and provide examples and visuals to help you feel more confident about your income tax. What’s Inside This Guide Misunderstanding income tax rates and bands How tax rates and bands work Income tax bands explained using a pie analogy Examples of how income tax is calculated What is a marginal tax rate? Why understanding tax bands matters Example: Working extra hours or accepting a promotion

If you’re self-employed — whether as a contractor, freelancer, or running your own solo business — chances are you’ve come across the term IR35. It’s one of those bits of tax legislation that often confuses people and, at times, causes unnecessary worry. Let’s clear things up: IR35 doesn’t apply to sole traders. But that doesn’t mean there aren’t other important tax and compliance considerations. At SBX Accountants, we’re here to help self-employed individuals stay informed, compliant, and efficient — without the confusion .

Starting out as a sole trader can be an exciting step, but before diving in, it’s important to understand exactly what it involves. From legal responsibilities to financial obligations, there’s a lot to consider. At SBX Accountants, we break it all down so you can confidently manage your business and stay on top of your compliance.